Life coverage is an economic protection internet, but many people still ask What Is Term Life Insurance and why it is considered the maximum less expensive safety plan. In simple words, time period life insurance presents a high life cowl at a low price for a set length, making sure your own family’s financial protection if something occurs to you.

This in depth guide explains What Is Term Life Insurance, how it works, its benefits, kinds, prices, and who can purchase it, helping you make a knowledgeable choice.

Table of Contents

What Is Term Life Insurance? (Simple Explanation)

What is term existence insurance?

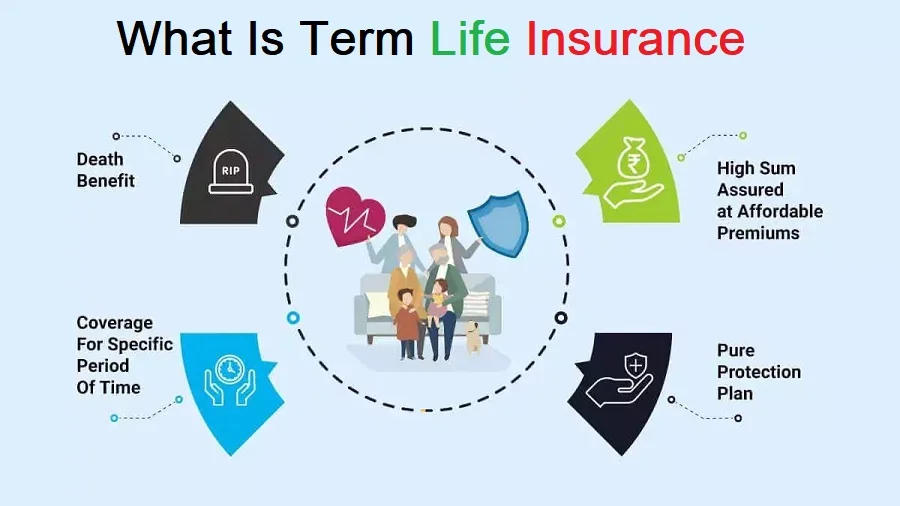

Term lifestyles coverage is a natural safety lifestyles coverage plan that offers a massive sum assured for a precise term (time period). If the policyholder dies during the policy time period, the nominee receives the death gain. If the policyholder survives the time period, no maturity advantage is paid.

Key Definition

Term lifestyles insurance = High coverage + Low top class + Fixed time period

How Does Term Life Insurance Work?

Understanding What Is Term Life Insurance becomes simpler when you know how it works step by step.

Working Process

- You pick a coverage time period (10, 20, 30, or greater years)

- Select a sum confident

- Pay normal premiums

- If death occurs for the duration of the time period → Nominee receives payout

- If you live on → Policy ends

Key Features of Term Life Insurance

| Feature | Details |

|---|---|

| Policy Type | Pure protection |

| Coverage Duration | Fixed term |

| Premium Cost | Low |

| Maturity Benefit | No |

| Death Benefit | Yes |

| Tax Benefits | Yes (as per law) |

Why Term Life Insurance Is Important

People often ask What Is Term Life Insurance and why do I need it? The answer lies in economic protection.

Main Reasons

- Income replacement

- Debt safety

- Children’s education security

- Family lifestyle renovation

- Peace of thoughts

Types of Term Life Insurance Plans

Understanding the kinds facilitates clarify What Is Term Life Insurance in actual global scenarios.

1. Level Term Insurance

- Same sum assured in the course of the policy

- Most famous and less expensive

2. Increasing Term Insurance

- Coverage increases over time

- Helps fight inflation

3. Decreasing Term Insurance

- Coverage reduces through the years

- Ideal for home loans & EMIs

4. Return of Premium Term Insurance

- Premiums lower back if you continue to exist

- Higher premium than normal time period plans

Types Comparison Table

| Type | Coverage Change | Best For |

|---|---|---|

| Level Term | No change | General protection |

| Increasing Term | Increases | Inflation protection |

| Decreasing Term | Decreases | Loans |

| Return of Premium | Same | Savings + protection |

What Is Term Life Insurance Premium?

The premium is the amount you pay to keep your policy active.

Premium Depends On

- Age

- Health situation

- Lifestyle habits

- Policy time period

- Sum confident

Example Premium Table

| Age | Coverage | Term | Monthly Premium |

|---|---|---|---|

| 25 | ₹1 Crore | 30 Years | Low |

| 35 | ₹1 Crore | 25 Years | Medium |

| 45 | ₹1 Crore | 20 Years | Higher |

Who Should Buy Term Life Insurance?

If you’re wondering what’s term lifestyles insurance and who needs it, here’s the answer:

Ideal Buyers

- Working professionals

- Parents

- Business proprietors

- Single earnings families

- Loan holders

What Is Term Life Insurance Coverage Amount?

Coverage ought to be 10–15 times your annual income.

Coverage Calculation Table

| Annual Income | Suggested Coverage |

|---|---|

| ₹5 Lakh | ₹50–75 Lakh |

| ₹10 Lakh | ₹1–1.5 Crore |

| ₹20 Lakh | ₹2–3 Crore |

Benefits of Term Life Insurance

Major Benefits

- High coverage at low price

- Financial safety for own family

- Tax advantages

- Flexible policy term

- Riders to be had

Popular Riders in Term Life Insurance

Riders decorate your base plan.

| Rider | Benefit |

|---|---|

| Accidental Death | Extra payout |

| Critical Illness | Lump sum payout |

| Waiver of Premium | Premium waived |

| Disability Rider | Income protection |

Term Life Insurance vs Other Life Insurance Plans

| Feature | Term Plan | Endowment | ULIP |

|---|---|---|---|

| Cost | Low | High | Medium |

| Returns | No | Yes | Market-linked |

| Risk Coverage | High | Medium | Medium |

| Purpose | Protection | Savings | Investment |

Common Myths About Term Life Insurance

Myth 1: No adulthood means waste

Truth: The reason is protection, no longer financial savings.

Myth 2: It’s simplest for younger people

Truth: Anyone with dependents should purchase it.

How to Choose the Best Term Life Insurance

When understanding what term exists, choose topics.

Checklist

- Claim agreement ratio

- Premium affordability

- Rider options

- Policy time period

- Company recognition

Claim Process in Term Life Insurance

Simple Claim Steps

- Inform insurer

- Submit documents

- Verification

- Claim settlement

Why Term Life Insurance Is Better Than No Insurance

Without insurance:

- Family faces monetary trouble

- Loans continue to be unpaid

- Lifestyle compromised

With time period insurance:

- Financial stability

- Debt-unfastened future

- Secure dependents

Future Value of Term Life Insurance

As scientific prices upward push and earnings risks increase, time period life coverage will become extra critical. Understanding what is time period life coverage these days can defend your family the following day.

Summary

What is term life insurance? It is a low priced lifestyle coverage plan offering excessive insurance for a set length. It protects your circle of relatives financially in case of your untimely loss of life, making it the handiest and crucial life coverage choice for long-time period security.

Main questions to ask on this – What Is Term Life Insurance

Is term existence insurance higher than other plans?

Yes, for natural protection, time period lifestyles coverage is the great and most inexpensive choice.

Does time period life coverage give maturity advantages?

No, time period existence insurance does not now provide adulthood advantages, except go back-of-top rate plans.

How much time period life coverage do I want?

You can buy 10–15 instances of your annual earnings for proper economic protection.

Can I upload riders to term lifestyles coverage?

Yes, riders like critical infection and unintended loss of life can be delivered for additional safety.